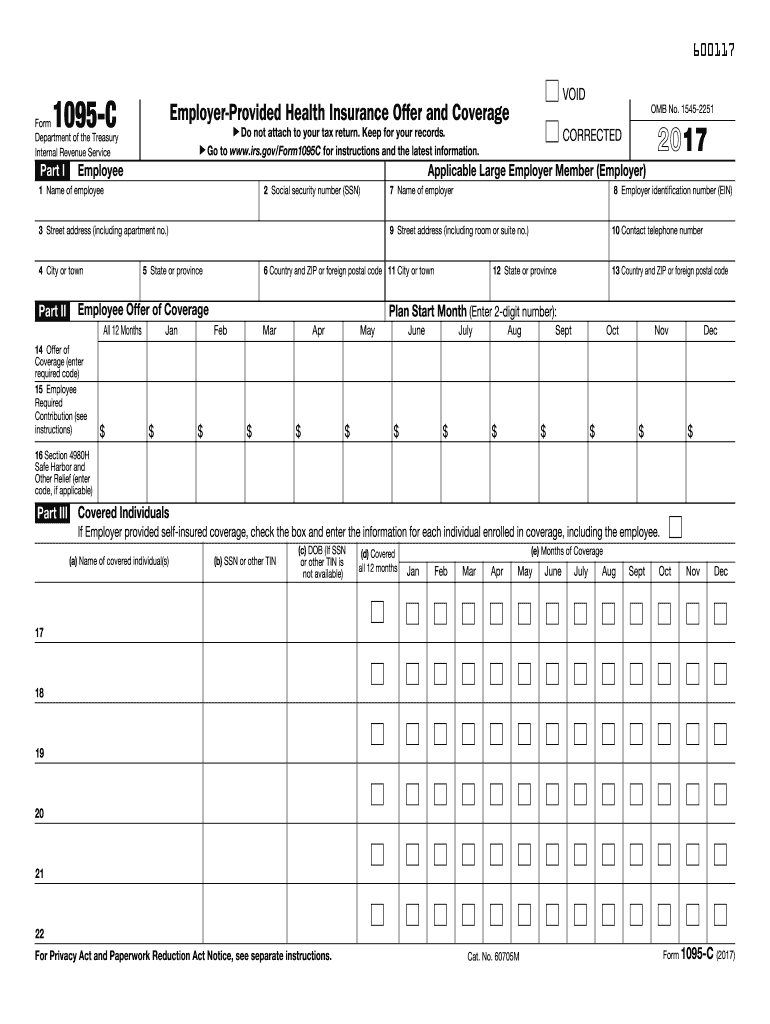

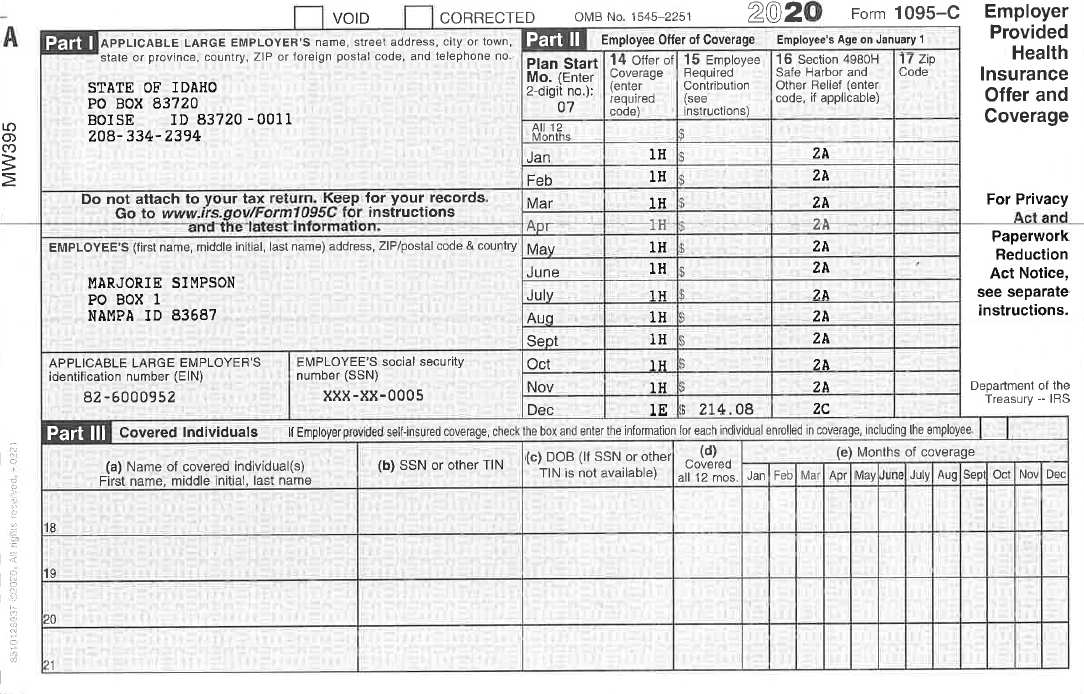

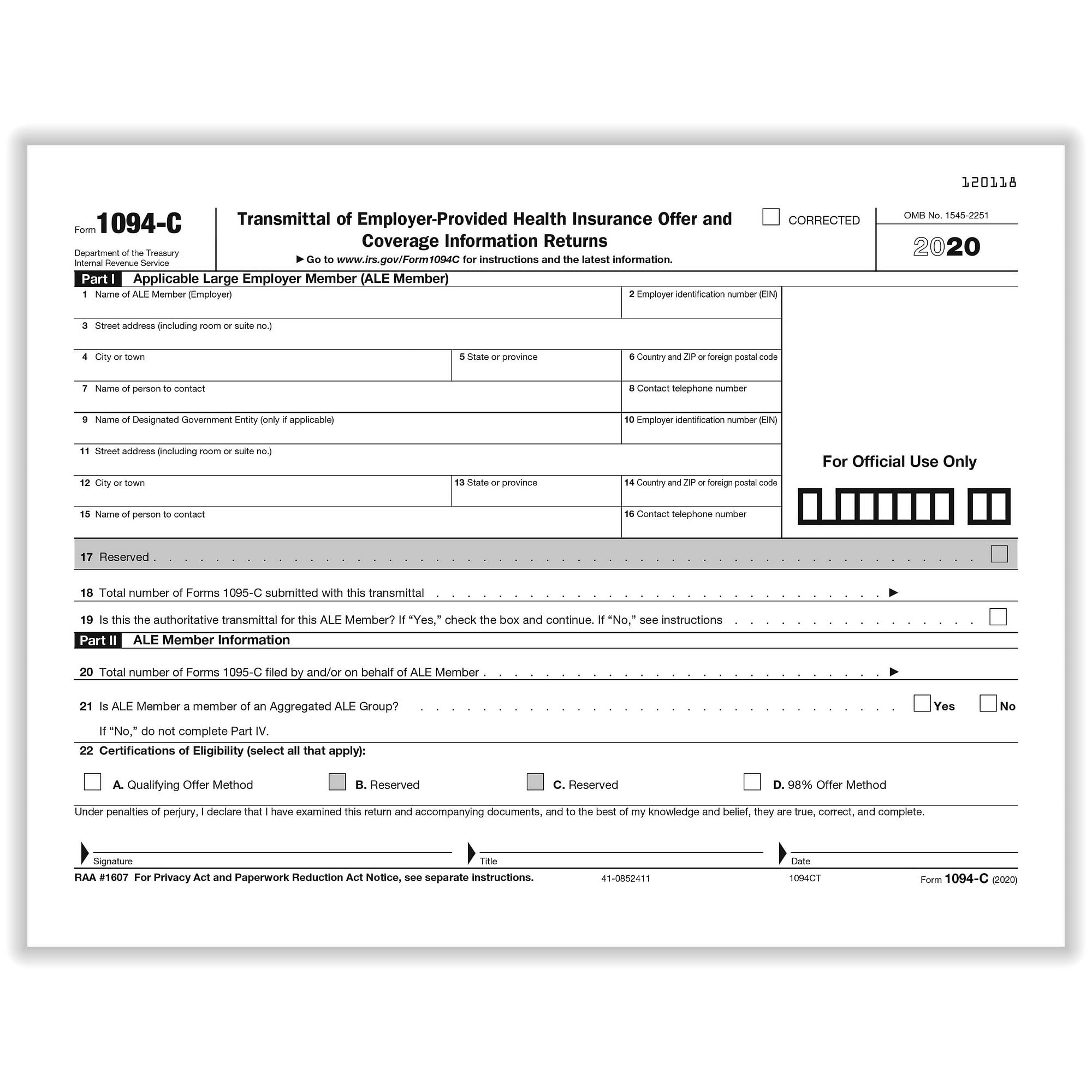

You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part Form 1095C This tax form is normally sent to employees by their employer prior to January 31 each year IRS Notice 76 (page 6, paragraph A) extends the deadline to provide the form by Form 1095C for federal civilian employees paid by DFAS and military members will be available on myPay NLT January 31 Forms will be mailedAbout Form 1095C, EmployerProvided Health Insurance Offer and Coverage Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

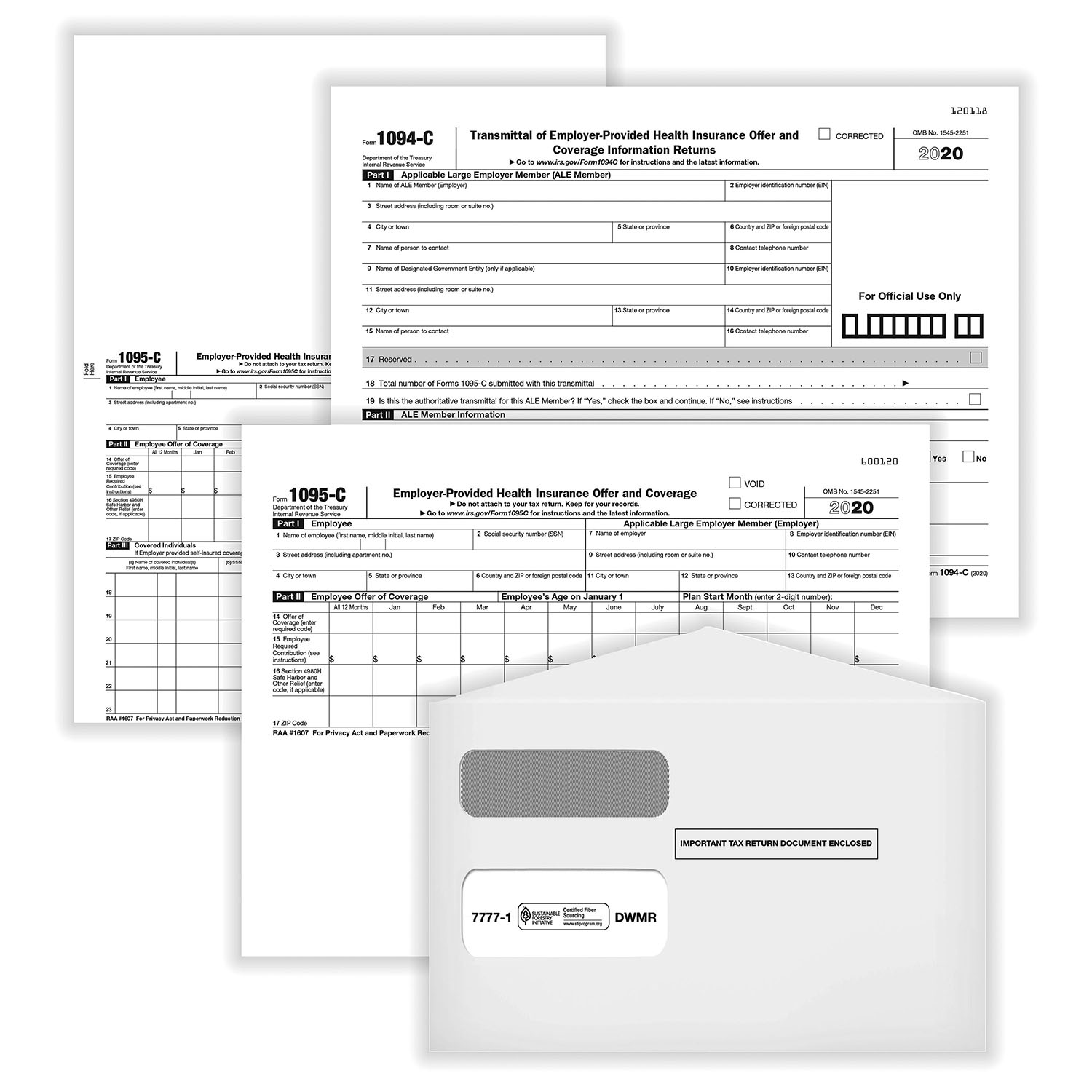

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

1095 c form 2018

1095 c form 2018-You can import your forms from Excel, or key them in, and have them printed & mailed by The 1094B & 1094C summary transmittals will be filed by our SSAE 18 SOC I Type II secure Service Bureau byThe IRS uses the information from Form 1095C to administer the Employer Shared Responsibility provision The Form also helps the IRS administer premium tax credits for any employee who qualified and enrolled for coverage at a Health Insurance Marketplace rather

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

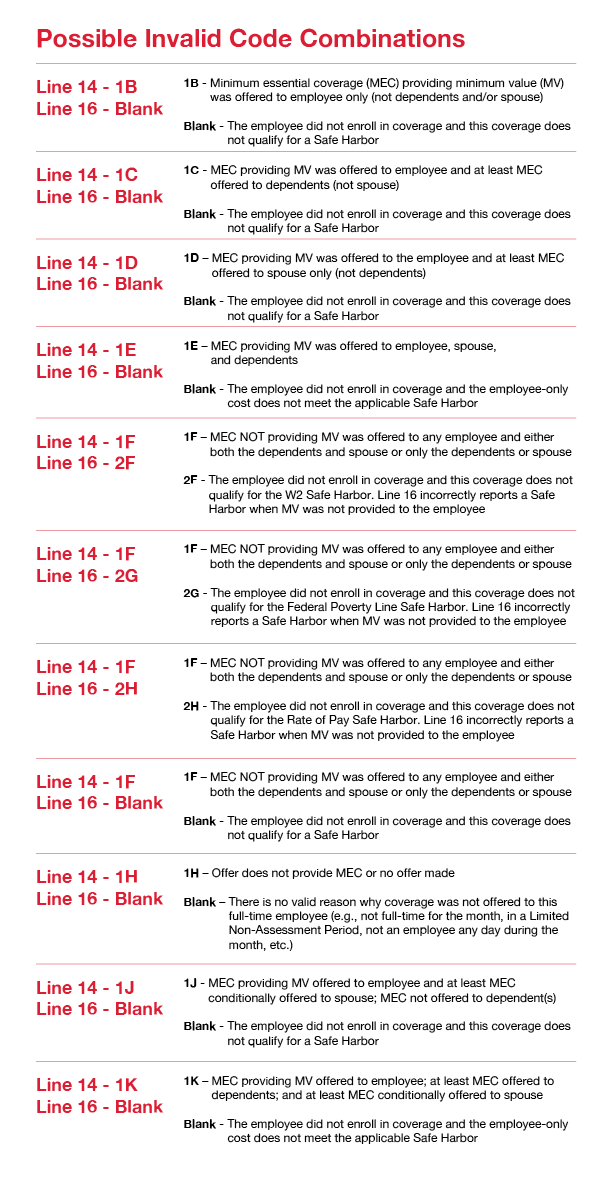

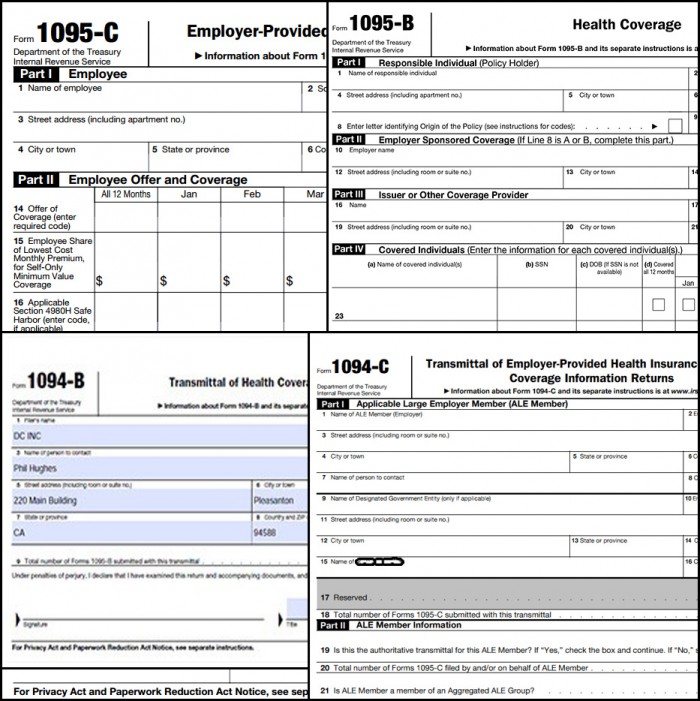

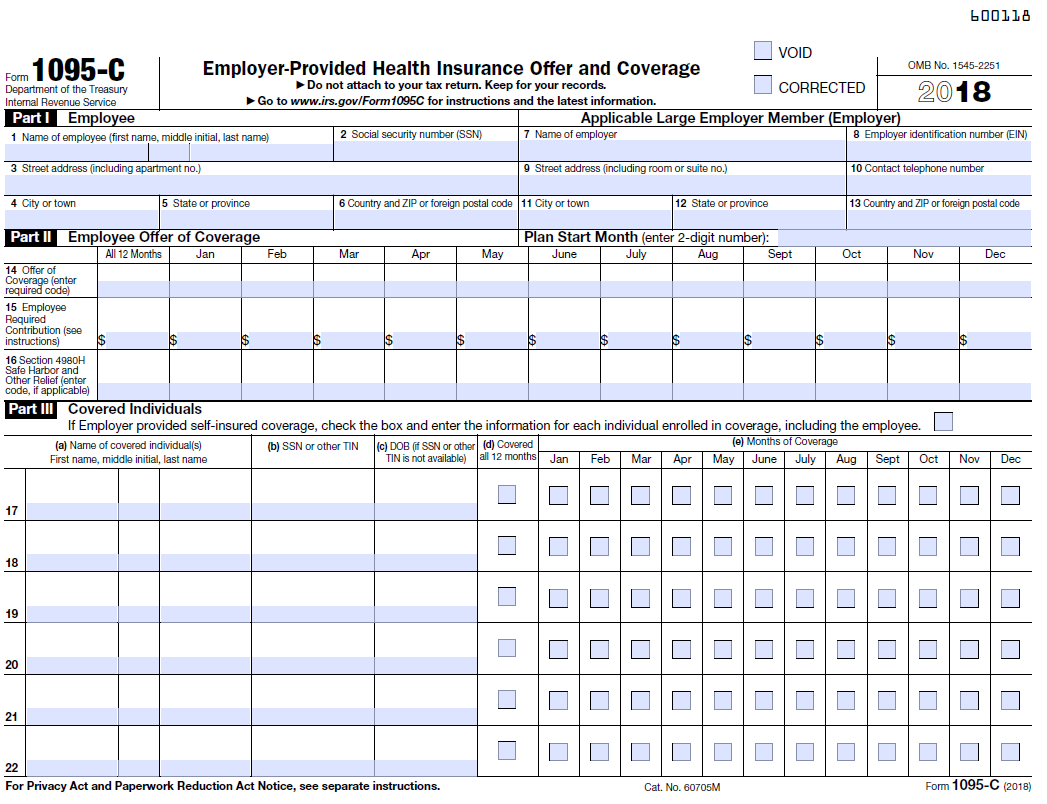

Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 182 Understanding ACA Form 1095C Line 14 and 16 Codes One of the essential aspects of Form 1095C is understanding how to communicate information regarding employees' coverage To do this, Employers will need to use Code Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season

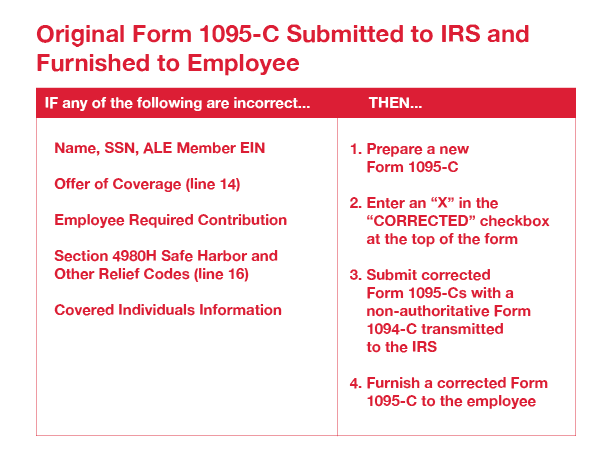

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselves

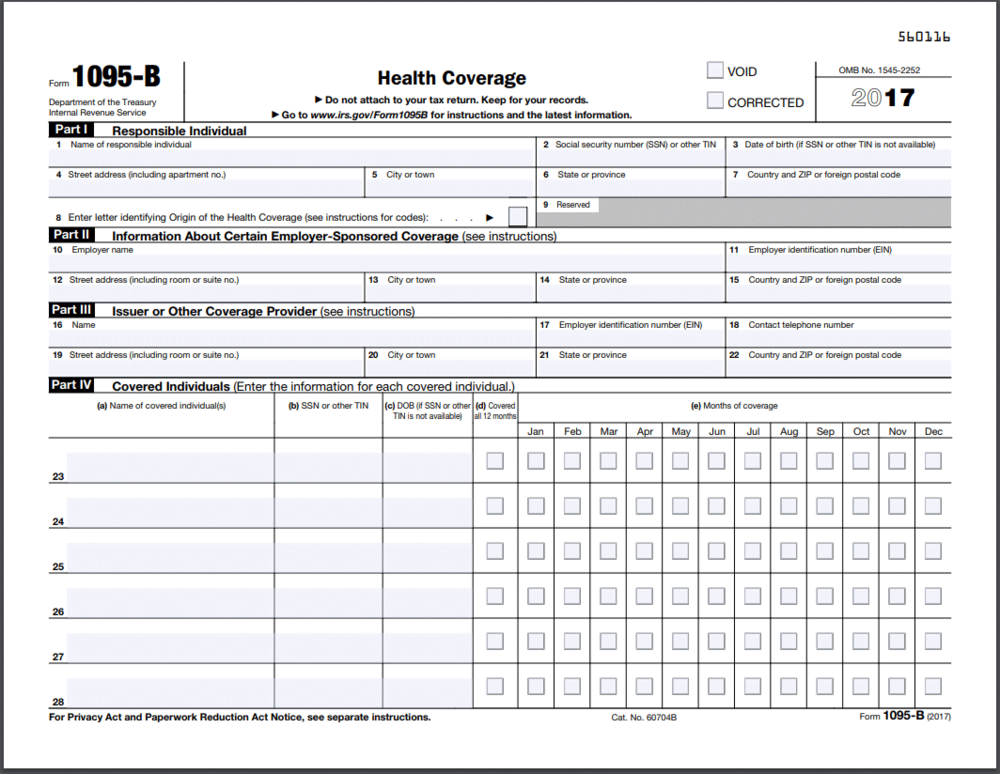

You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, PartForm 1095B, Health Coverage, should come in the mail if you purchased or received insurance outside of an exchange Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees inForm 1095B Proof of Health Coverage NOTE Your Form 1095B is proof of healthcare insurance for the IRS and does not require completion or submission to DHCSPlease keep this form for your records To understand more about the Federal and State Individual Mandates, please see the information and links below

Sample 1095 C Forms Aca Track Support

Changes Coming For 1095 C Form Tango Health Tango Health

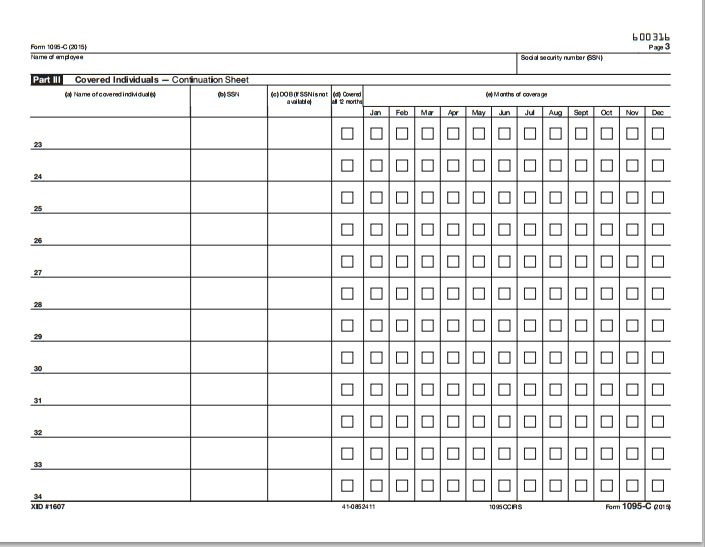

Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is issued by large employers required to offer coverage to employees This form reports both Offer of coverage to an employee Coverage of the employee if the employer is selfinsured and the employee enrolls in coverage However, just like with the 1095B, most The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are ApplicableForm 1095C, Employer Provided Health Insurance Offer and Coverage provides coverage information for you, your spouse (if you file a joint return), and individuals you claim as dependents had qualifying health coverage (referred to as 'minimum essential coverage") for some or all months during the year NoteEmployers are required to furnish only one Form 1095C for all individuals

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

Your 1095 C Obligations Explained

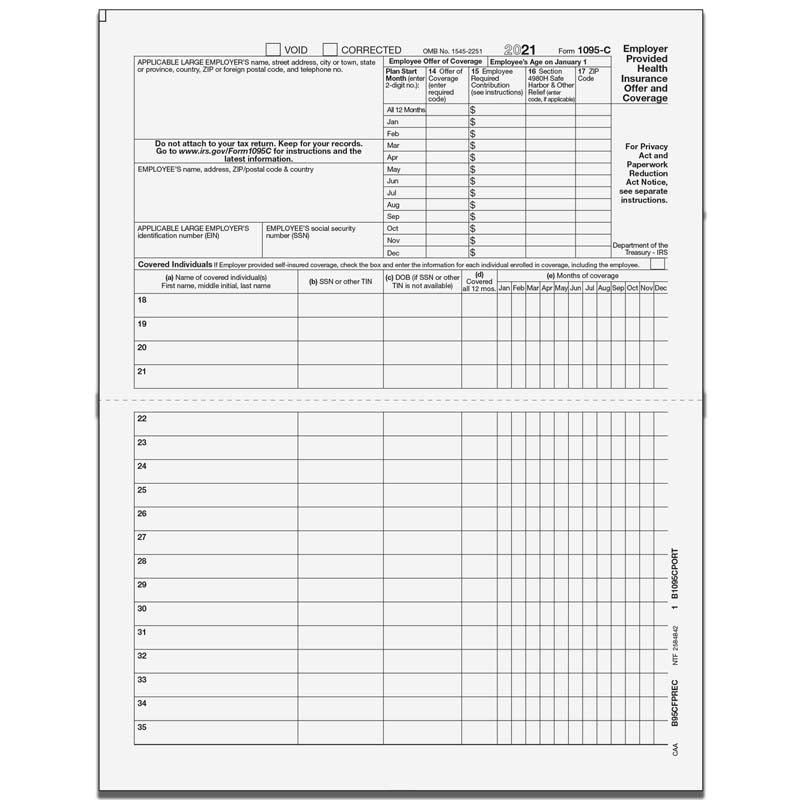

In the month of May, the IRS released a draft version of 1095C & 1095B These instructions are a helpful guide for mandatory ACA reporters who will need to incorporate these changes in their 22 ACA reporting Last year, the IRS mandated the reporting of ICHRA Coverage on Form 1095C by adding the new codes and lines Now, the IRS has released a draft versionYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provision in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered toForm 1095C is a required tax document under the Affordable Care Act (ACA) It contains detailed information about the medical coverage offered to you and your dependents by Miami University You will need the information from Form 1095C as part of your federal tax return The IRS will use this information, in part, to validate your compliance

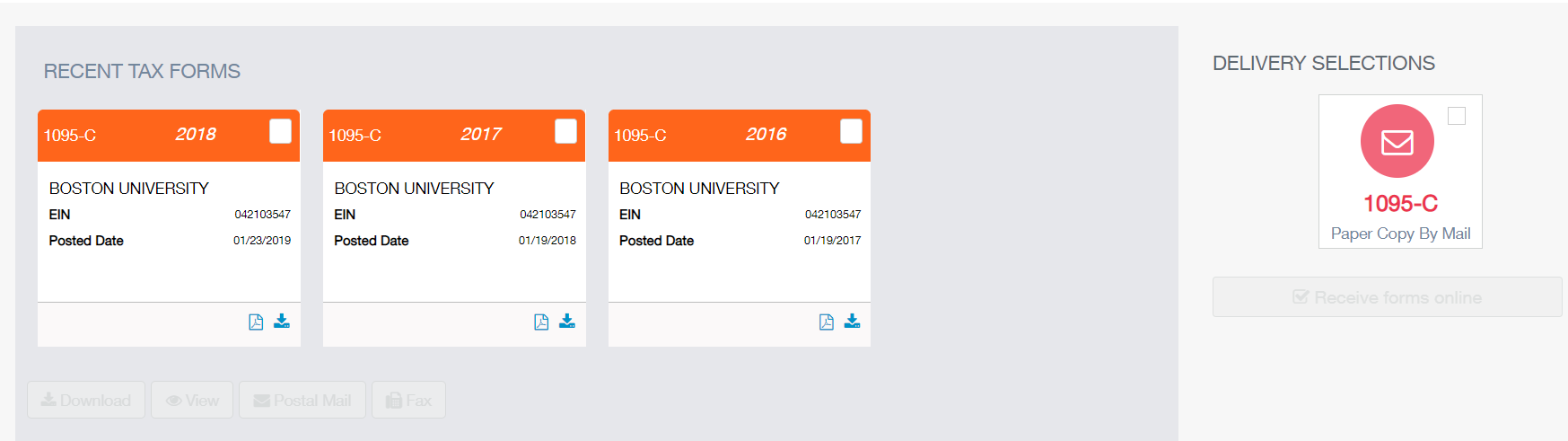

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Line 15 on the 1095C is for the employee required contribution Line 15 is only required if you entered code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, 1Q, 1T, 1U on line 14 To complete line 15, enter the dollar value of the employee required contribution, which is generally the employee share of Form 1095C Form 1095C, employerprovided health insurance offer and coverage, shows the coverage that is offered to you by your employer It is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form provides information of the coverage your employer offered and whether or not you chose to participateForm 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage

Irs Distribution Deadline January 31 22 Aca Gps

Enroll In Employer Sponsored Health Insurance With Irs Form 1095 C

IRS Adds Two New Codes on ACA Form 1095C In early May, 21, the IRS released a Form 1095C draft, which adds two new 1095C codes 1T and 1U for employers to meet the ICHRA reporting requirements An ICHRA is an employersponsored reimbursement plan that allows employees to purchase their health insurance plan privately or on the open market Form 1095C is a tax form that provides you with information about employerprovided health insurance Only employees who is offered coverage under a policy through an Applicable Large Employer (ALE) receive Forms 1095C, and it is the responsibility of the ALE to generate and furnish the documents to all employees who were fulltime (as Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return

Accurate 1095 C Forms Reporting A Primer Integrity Data

1094 C 1095 C Software 599 1095 C Software

The new Form 1095C requires a large amount of information that employers must track throughout the calendar year Forms must be sent to employees annually by January 31 Companies with more than 250 employees are required to electronically file copies with the IRS and submit a transmittal Form 1094C by March 31What is IRS Form 1095C?Form 1095C is used by the IRS to determine if the employer owes a payment under the employer shared responsibility provisions under section 4980H It is also used to determine if an employee is eligible for premium tax credit Form 1094C is a summary form that is filed with form 1095C electronically or on paper

Overview Of 1095c Form

Your 1095 C Tax Form For Human Resources

Form 1095B Form 1095B is sent out by health insurance carriers, governmentsponsored plans such as Medicare, Medicaid, and CHIP, and selfinsured employers who aren't required to send out Form 1095C instead This form is mailed to the IRS and to the insured member If you buy your own coverage outside the exchange, you'll receive FormForm 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2 to be reported on line 16 of Form 1095CForm 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS

trix Irs Forms 1095 C

Form 1095 C H R Block

What is Form 1095C?A 1095C form is like a W2 form Employers send one copy to the Internal Revenue Service (IRS) and one copy to you A W2 form reports your annual earnings A 1095C form reports your health care coverage throughout the year 2 Who is sending it to me, when, and how? IRS Form 1095C is one of the Affordable Care Act Forms offered by Tax1099 The form is for reporting information to the IRS and to taxpayers about individuals not covered by minimum essential healthcare coverage The health care law defines that employers must offer health insurance to their workers

Your 1095 C Tax Form My Com

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out We offer eFiling for 13 through tax forms!Form 1095 is sent to the individual by whoever provides them with health insurance, be it the health insurance marketplace for Form 1095A, a small selffunded group or small business for Form 1095B, or by their (50 fulltime employees) employer for Form 1095C Form 1095 is only sent to the individual and for his or her own reference;

1095 Software Aca Software And 1095 C Irs 6056 Compliance

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

On , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from How do I complete line 15 on the 1095C form? The number of 1095C forms that are being filed A direct contact The employer, including contact information and the organization's EIN IRS Issues Draft Form 1095C for Filing in 22 In July 21, the IRS released a draft Form 1095C for filing in 22, which applies for coverage held in 21 While the drafts don't include any major

Irs Form 1095 C Uva Hr

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Like Forms 1095A and 1095B, Form 1095C is proof you had health care insurance But, as explained above, this is no longer important because there is no longer a penalty for not having insurance You don't need Form 1095C to file your tax return So please don't wait until you receive it to prepare your return IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you byACA Online Filing We file 1095B forms online and file 1095C forms online!

1095 C Forms Half Sheet With Instructions At Bottom Discount Tax Forms

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

I have Covered California from July to Dec (1095A Form), my previous employer sent me 1095C for Jan to May but there is no where I can enter on Turbo Tax I heard if you don't have health insurance for 3 months you are fined Funny that if I delete my 1095A from my TurboTax my refund goes up by $10IRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056Also it is used to determine whether an ALE Member

Instructions For Forms 1095 C Taxbandits Youtube

1095 C Faqs Mass Gov

Need To Correct An Irs 1094 C Or 1095 C Form

1095 C Employer Provided Health Insurance Offer Of Coverage

Amazon Com 18 Complyright 1095 C Irs Employer Provided Health Insurance Form Pack Of 100 1095cirsamz Office Products

1

Cobra Retiree 1095 C Form Questions Answered Tango Health

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

1095 C Forms Complyright Software Version Zbp Forms

2

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

1095 C Preprinted Portrait Version With Instructions On Back

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

1094 C 1095 C Software 599 1095 C Software

Payroll 1095 C Information Affordable Care Act Aca

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

An Overview Of 1095 A 1095 B 1095 C Affordable Care Act Forms

Changes Coming For 1095 C Form Tango Health Tango Health

17 Tax Year Affordable Care Act Reporting

1

Affordable Care Act Form 1095 C Hrdirect

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Aca 1095 C Basic Concepts

Form 1095 A 1095 B 1095 C And Instructions

1095 C Form Educating Employees And Filing Extensions Tango Health

Annual Health Care Coverage Statements

Irs Extends Deadline For Employers To Furnish Forms 1095 C And 1095 B Chicago Employee Benefits Byrne Byrne And Company

1095 C Form Official Irs Version Discount Tax Forms

1095 C Continuation Forms Official Irs Version Zbp Forms

Your 1095 C Obligations Explained

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

What Is An Irs Form 1095 C Boomtax

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

1095 C Print Mail s

No 10 Dg 1 1095 C Form Double Window Envelopes With Blue Wesco Inside Security Tint 4 1 8 X 9 1 2 White 24 Lb Paper W Vellum Finish Sfi Certified Box Of 500 Envelopes Walmart Com Walmart Com

What Is The Irs 1095 C Form Miami University

Form 1095 C Guide For Employees Contact Us

Form 1095 C Mailed On March 1 21 News Illinois State

Do Dependents Spouse Need To Be Reported On 1095 C Forms

Form 1095 C Forms Human Resources Vanderbilt University

Verify That Names And Social Security Numbers Are Correct For Form 1095 C News Vanderbilt University

Control Tables And Sample Forms

2

Irs Form 1095 C Fauquier County Va

1095 C 18 Public Documents 1099 Pro Wiki

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

1095 C Form 21 22 Irs Forms

What Payroll Information Prints On Form 1095 C To Employees

1095 C Employer Provided Health Insurance Irs Copy For 21 5098b Tf5098b

Accurate 1095 C Forms Reporting A Primer Integrity Data

Understanding Your 1095 C Documents Aca Track Support

Preprinted 1095 C Full Page Form W Instructions B95cfprec05

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Irs Extends Deadline For Furnishing Form 1095 C To Employees Woodruff Sawyer

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Irs Form 1095 C Codes Explained Integrity Data

3

1095 C Form 21 22 Finance Zrivo

What Is Form 1095 C And Do You Need It To File Your Taxes

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

1095 C Continuation Forms For Complyright Software Discount Tax Forms

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Pressure Seal 1095 C Form Ez Fold Zbp Forms

Accurate 1095 C Forms Reporting A Primer Integrity Data

2

1

1095 C Tax Form 35 Images Let Your Employees About The New Tax Reporting Forms 1095 Confused About Irs Health Coverage Form 1095

2

Irs 1095 C Form Pdffiller

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1095 C Template Fill Online Printable Fillable Blank Pdffiller

Your 1095 C Tax Form For Human Resources

Your 1095 C Obligations Explained

0 件のコメント:

コメントを投稿